Big Oil: Where Have All the Profits Gone?

Staff Report

BIG OIL: Where Have All the Profits Gone?

Billions Siphoned Off Consumers at the Pump Going to Executive Pay, Stock Buybacks and Public Relations Campaigns – NOT Renewable Energy

May 21, 2008

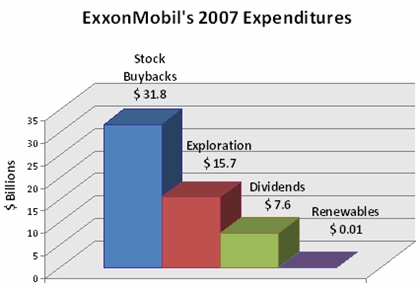

Select Committee staff review of recent earnings reports, annual reports, and other filings with the U.S. Securities and Exchange Commission from the five largest investor-owned oil companies—ExxonMobil, British Petroleum, Shell, ConocoPhillips, and Chevron—demonstrate how all-time high oil prices are translating into record-breaking corporate profits. Oil prices have reached $129 a barrel and regular gasoline averages $3.79 per gallon around the country. As consumers suffer declines in real income and purchasing power, profits for the big five oil companies topped $123 billion in 2007. Rather than advancing a strategy that vigorously incorporates renewable energy alternatives, oil company profits have been spent largely to fund huge increases in executive compensation, stock buy-back programs, and public relations campaigns. ExxonMobil—the largest of the oil majors—recorded $40 billion in profit in 2007. Majority staff analysis of Exxon’s recent expenditures show how the most profitable company in the world chose to spend its profits in 2007:

- Repurchased $31.8 billion worth of stock.

- Distributed $7.6 billion in dividends to shareholders.

- Increased compensation for its top five executives to $76 million, a 170% increase since 2001.

- Financed a sophisticated advertising campaign, designed to distract consumers and deflect attention from high gas prices. Specifically, it helped to finance full page ads in USA Today, the New York Times, the Los Angeles Times, The Washington Post and several other major daily newspapers that seek to show that the oil companies with $123 billion in combined annual profits really are not that rich. Advertising executives estimate that this public relations campaign costs in the neighborhood of $100 million.

- Invested roughly $10 million in renewable energy alternatives.

The House of Representatives has passed legislation several times over the past year—most recently H.R. 5351—that would repeal $18.5 billion in tax breaks that the major oil companies receive over the next 10 years and redirect these incentives to companies producing energy from renewable sources. President Bush and Senate Republicans continue to oppose this approach, as do each of the five largest investor-owned oil companies.

Executive Compensation

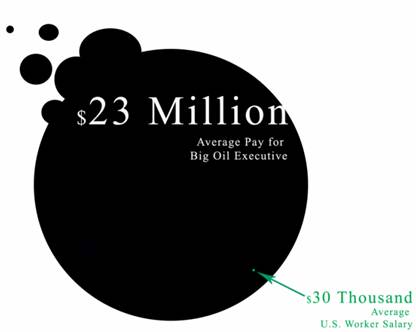

Oil prices have risen nearly 400 percent since 2001, increasing the average price of regular gasoline from $1.42 a gallon to $3.79. The average American driver now pays about $2,250 per year for gasoline – that’s an increase of $1,400 over what consumers spent in 2001. For the average American worker earning $30,000 in a year, gasoline now consumes 8% of their annual, pre-tax earnings.

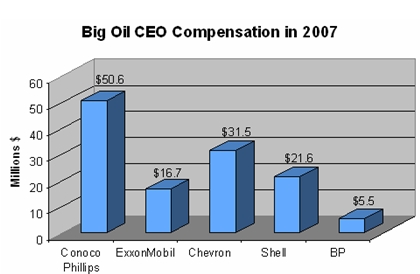

As real income growth stalls and purchasing power shrinks for working Americans, executive pay in the oil industry booms. The total compensation for the top five executives at ExxonMobil has gone from $28 million a year in 2001 to $76 million in 2007, a 170% increase. Average compensation for the CEOs of the five oil majors is over $23 million per year, a figure 766 times greater than the earnings of the average U.S. worker.

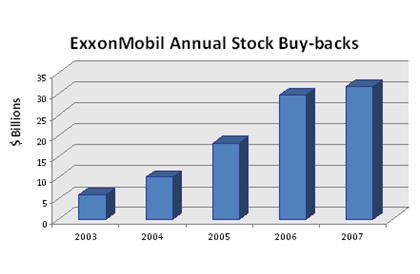

When companies believe their stock to be undervalued, repurchasing shares in the open market is one way to increase shareholder value. A stock repurchase, however, also demonstrates that the company is unable to find better alternatives for investing the capital internally to further grow the business. The oil industry in the past five years has undertaken one of the largest stock buybacks in the history of capitalism. Spending on share buybacks for the five major oil companies went from under $10 billion a year in 2003 to nearly $60 billion a year in 2006. At ExxonMobil, stock buybacks grew to $31.8 billion in 2007. As the figure below demonstrates, the amount of money spent on stock buy-backs at ExxonMobil has increased five fold in just four years.

Big Oil has increased spending on stock repurchases from $7.9 billion in 2003 to $57.7 billion in 2007 – an increase of 630 percent. The increase in Big Oil’s spending on stock buybacks in recent years has been so remarkable, and indeed unprecedented, that Exxon spent more repurchasing its own shares in the first quarter of 2008 – $8 billion – than all the major oil companies spent on stock buybacks for all of 2003.

Exploration and New Production With oil at $129 a barrel, oil companies are certainly investing in more production. For the major oil companies as a whole, capital investment in exploration has increased 77 percent over the last five years. However, the great majority of this investment aims at getting more oil out of existing oil fields rather than finding new fields. Exploration of new oil fields went from just $6 billion in 2003 to $10 billion in 2006. The evidence from their financial filings indicates that the big five oil companies have not responded to the overwhelming market signals by devoting a larger share of their soaring profits and cash flow to exploration of new fields. Plenty of opportunities exist for new exploration on federal land. According to the U.S. Minerals Management Service, production is currently occurring on just 20 percent of the 38.5 million acres of outer continental shelf that oil and gas companies currently hold drilling rights to. Onshore, oil companies hold the drilling rights to nearly 43 million acres of federal land and are only producing on 28 percent, according to the Bureau of Land Management.

The money being invested in all types of production still pales in comparison to the value being returned to shareholders in the form of dividends and stock buy-backs. While ExxonMobil has increased capital investment in drilling and exploration from $12 billion in 2003 to $15.7 billion in 2007 – an increase of roughly 30 percent – ExxonMobil has increased spending on stock buybacks from $5.9 billion in 2003 to $31.8 billion in 2007 – a five-fold increase.

Public Relations Campaign

The American Petroleum Institute (API), the oil industry's primary lobby group, has embarked on a multimillion-dollar campaign to create the perception that the industry is doing all it can to help consumers feeling the pain and the gas pumps. The industry is hosting trips out to oil rigs for journalists and bloggers, airing television commercials, conducting news conferences, and buying full-page advertisements in the nation’s largest newspapers to get out the message. API’s president, Red Cavaney, has not put a dollar amount on the multimedia public relations campaign, only saying it is less than $100 million.[3] Of course, all industries undertake public relations and advertising campaigns. It bears noting however, that the advertising budget for this one industry campaign is 10 times larger than what Exxon Mobil invested in renewable energy.

Double-speak on Renewable Energy Alternatives

According to testimony given before the Select Committee on Energy Independence and Global Warming on April 1, 2008, ExxonMobil is aware of and deeply concerned with the current energy and climate challenge facing America. Senior vice president J. Stephen Simon explained the urgency of the situation: “Our analysis is that we are not going to be able to meet the challenge that you (Mr. Markey) would like to meet and I would like to meet with current generation. That is our assessment. We need to leapfrog current generation technology. We need to have world-changing breakthroughs, and that is what the objective of our global climate and energy project is… We are looking at solar. We are looking at biofuels, biomass.”

However, to spur these “world-changing” breakthroughs, ExxonMobil has pledged to invest around $10 million per year for ten years. This amounts to less than three hundredths of one percent of the company’s annual profit. It is fair to ask whether such a miniscule investment demonstrates a genuine commitment to “world-changing” breakthroughs. One could look at that same evidence and conclude that ExxonMobil’s approach to renewable energy alternatives is more accurately summed up as defeatist. Mr. Simon testified to the committee: “[P]utting more money into something does not necessarily equal progress...If we identify an area where we think it can have the impact that you are alluding to, we will do that, but we have studied all forms (of renewable energy), even anticipating some improvements, and the current technologies just do not have an impact, any kind of appreciable impact on this challenge that we are trying to meet.” The figure below shows how investment in renewable alternatives compared to other expenditures at ExxonMobil in 2007.

Conclusion

The House of Representatives has repeatedly passed legislation that would reclaim $18 billion in tax breaks over the next 10 years that was given to the major oil companies by the Republican Congress and the Bush Administration in 2005 and reinvest that money in renewable energy technologies to help consumers and reduce global warming pollution. Pro-drilling advocates have repeatedly argued that those tax breaks for Big Oil are needed in order to allow for continued domestic oil and gas development. However, the facts of Big Oil’s spending paint a different picture.

While the investment of major oil companies in exploration has increased over the last five years, it has lagged well behind the more than five-fold increase in spending on schemes to prop up the price of their stock. As American consumers are being forced to empty one pocket at the pump because of high gas prices, they are also being forced to subsidize tax breaks for Big Oil. These companies are spending the bulk of their profits not on new exploration or renewable energy, but instead on schemes to buoy their stock price.

The Select Committee was active during the 110th and 111th Congresses. This is an archived version of the website, to ensure that the public has ongoing access to the Select Committee record. This website, including external links, will not be updated after Jan. 3rd, 2010.

![]() del.icio.us

del.icio.us

![]() Digg this

Digg this

![]() Reddit

Reddit

![]() Stumbleupon

Stumbleupon